UPDATE: NASCAR and Teams Settle Antitrust Lawsuit

What’s Happening? 23XI Racing and Front Row Motorsports have settled their antitrust lawsuit filed against NASCAR, bringing this long-running saga to…

Last week, NASCAR settled the antitrust lawsuit filed by charter-owning teams 23XI Racing and Front Row Motorsports. As a result of the settlement, reports are indicating that charter values are rising, but what does this look like, and what could it mean for team ownership in NASCAR?

What’s Happening? 23XI Racing and Front Row Motorsports have settled their antitrust lawsuit filed against NASCAR, bringing this long-running saga to…

Over the past 13 months, through all the debates about point formats, horsepower, and officiating calls, a lawsuit between NASCAR and two of its teams remained at the forefront of fan conversations.

At the core of this lawsuit were charters, something introduced to the sport in 2016 that gave the 15 teams that owned one or more of the sport’s 36 charters automatic entry into NASCAR Cup Series races and a share of TV revenue.

When NASCAR gave these charters to teams in 2016, they did so at no cost to the organizations. Though NASCAR did not profit from charters, the charters became an asset teams could sell (should they close down), far more valuable than equipment or a race shop.

Though these charters operate a lot like franchises, prior to the settling of 23XI and FRM’s lawsuit, they only existed under NASCAR’s permission, meaning that should the sport deem so, they could close down the system at the end of their contractual agreements.

During the latest round of charter negotiations, which lasted from late 2023 to late 2024, NASCAR’s 15 charter owning teams fought to make these charters “permanent,” a goal they would not achieve in negotiations.

Even when 23XI and FRM broke ranks and sued NASCAR, the sport would not yield on making charters permanent.

Furthermore, throughout the nine-day trial that spanned from December 1 to December 11, “permanent” or “Evergreen” charters were a hot topic on the witness stand, with everyone from Richard Childress Racing owner Richard Childress to NASCAR CEO and Chairman Jim France explaining why charters could or could not be valuable.

On day three of the trial, NASCAR Executive Vice President & Chief Strategy Officer Scott Prime speculated that charter permanence would not only bring security to NASCAR’s charter owning teams but could also double the value of those charters.

More insight today on the texts that occurred during the Charter agreements. #NASCAR executive Scott Prime said NASCAR CEO Jim France said “no bueno” to permanent charters, which the teams wanted. Prime estimated the Charter values would be at $100 million if they were permanent…

— Deb Williams (@DebWilliams72) December 3, 2025

While both parties held out on settling during the discovery period of the lawsuit and the first week and a half of the trial, if a settlement were reached, most expected it to include some form of permanent charters.

Of course, everything came to an end on December 11, when the two sides came to an agreement on a settlement that would add, among other new provisions, evergreen charters to the 2025 NASCAR Charter agreement.

Per early reports, including one from Adam Stern of Sports Business Journal, NASCAR executives are saying charters will “now at least top $50M in the next valuation,” and some are expecting them to, as claimed in the past by Prime, even double.

The most confident NASCAR team investors say that charters are already up close to 100% after being made permanent. https://t.co/IFspwfP7Ih

— Adam Stern (@A_S12) December 13, 2025

So, if teams are seeing an increase in charter value, what would that increase look like on the open market?

What’s Happening? Per its settlement with teams 23XI Racing and Front Row Motorsports, NASCAR will provide the sport’s 15 charter owning…

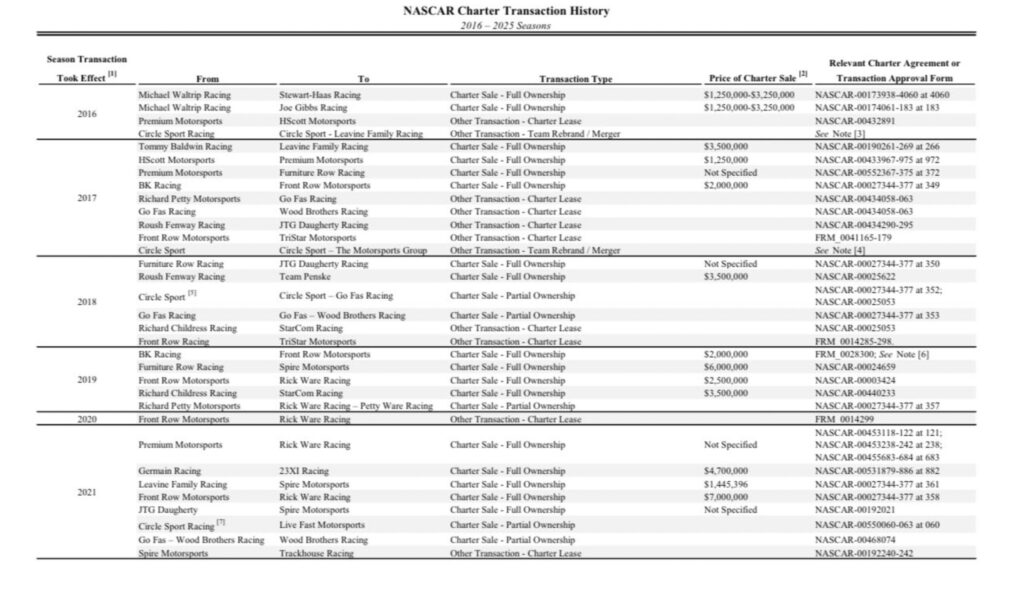

Thanks to this lawsuit, a form showing the sale price of NASCAR charters is now publicly available, giving fans a good perspective on just how much these charters have increased in value over the past ten seasons.

For example, in 2017, H-Scott Motorsports sold a charter to Premium Motorsports for $1,250,000. Just two years later, in 2019, a charter sale broke the $5 million mark when Spire Motorsports purchased Furniture Row Racing’s charter for $6 million.

Over the past few seasons, prices have only continued to climb, with Rick Ware Racing buying a charter from Front Row Motorsports for $7 million, and, just last season, 23XI Racing co-owner Michael Jordan paid $28 million for a charter from Stewart-Haas Racing.

However, the real meat of the matter has been found in the most recent sale, with Legacy Motor Club buying a charter from Rick Ware Racing for a reported $45 million.

What’s Happening? On the latest episode of the Dale Jr Download, a NASCAR insider revealed that Jimmie Johnson’s Legacy Motor Club…

Though this could have changed following a lawsuit between the two parties, this is slightly more than the approximately $40 million purchase that Spire Motorsports made ahead of the 2024 season, which is slightly less than the RWR sale, but much more than the Stewart-Haas fire sale that occurred after this $40 million sale.

Either way, if charter values have doubled, this means that lower-performing charters (performance factors into charter payouts), like the one LMC purchased from RWR, or the one that Spire purchased from Live Fast Racing, could reach the $100 million mark.

What’s Happening? NASCAR Hall of Famer and Seven-Time Champion Jimmie Johnson’s Legacy Motor Club is suing Rick Ware Racing over a…

The potential charter increase is, for the most part, good news for the race teams that already own a charter.

For reference, a team like Joe Gibbs Racing, which consistently fields top-end cars and owns four charters, could have a fleet worth nearly half a billion dollars thanks to the evergreen stipulation.

But this potential increase in value only adds to an already existing issue with the NASCAR Charter system, one that many traditional fans are very critical of.

While teams can start a Truck Series team and be successful from the start, take Spire and FRM, for example, or others can restart their O’Reilly Auto Parts Series team and thrive as Hendrick Motorsports has recently done, this is something more and more impossible in the NASCAR Cup Series.

Of course, the one team everyone always thinks of is JR Motorsports, co-owned by Dale Earnhardt Jr, who has flirted with the idea for some time.

In April, just a few months after his team’s first Daytona 500, Earnhardt called charter prices a “very challenging barrier of entry.” Something now even more difficult for him or any individual trying to break into NASCAR’s top level.

Though the early 2020s began a renaissance of new teams, these high prices could create a world where fans see even fewer new teams pop up than in years before.

What’s Happening? On Tuesday, the NASCAR industry learned via the Dale Jr. Download that Legacy Motor Club’s purchase of a Rick…

What do you think about this? Let us know your opinion on Discord or X. Don’t forget that you can also follow us on Instagram, Facebook, and YouTube.

by Bryan Aguiar

Three races in, the 2026 season is finally starting to show its hand. COTA shifted narratives, exposed weaknesses, and raised new questions about contenders, pretenders, and everything in between.

From substitute drivers being forced into action to points gaps growing faster than expected, COTA delivered more than just a road course chess match. There were momentum swings, reputation hits, and at least one young driver stacking up enemies before stacking up results.

Watch Also:

by Kauy Ostlien

NASCAR’s top two National Series head to the deserts of Arizona for the first short track race of the season at Phoenix Raceway. Here are the major storylines you need to keep in mind ahead of this weekend.

What’s Happening? NASCAR Cup Series veteran Erik Jones gave race fans a favorable review of NASCAR’s 2026 horsepower increase during a…

This weekend, NASCAR’s new Next Gen short track package makes its points-paying race debut at Phoenix.

Now, this package was first used in a race in the preseason clash at Bowman Gray Stadium, and last week at Circuit of the Americas (as it is used at all road courses this season). But this race will make its first use on a short track during the regular season.

With the increase in horsepower from 670 to 750, teams would like to get a handle on any potential changes that could come their way, as Phoenix is not only similar to tracks like Richmond, but is one of a handful of tracks that will make a regular season and Chase appearance.

The NTT IndyCar Series kicked off its 2026 season last weekend, in a joint event with the NASCAR Craftsman Truck Series at the St. Petersburg Grand Prix in Florida.

While the Trucks have the weekend off, the NTT IndyCar Series takes on Phoenix Raceway for their first race at the iconic venue since 2018, and their first joint weekend with the Cup Series since July 2020 at Indianapolis Motor Speedway.

Even though this is not the first time the Cup Series and IndyCar have shared a weekend, it is the first weekend the top two divisions of oval racing in the United States will share a track during a weekend, as, in 2020, IndyCar and the NASCAR Xfinity Series raced on the IMS Road Course, while the Cup Series raced on the oval.

We are three races into the 2026 NASCAR O’Reilly Auto Parts Series season, and as of right now, no team has looked particularly dominant.

While Austin Hill has a commanding lead after solid outings at Daytona, EchoPark, and COTA, Phoenix kicks off a stretch of races in which the series heads to more and more tracks that better reflect the bulk of the 2026 calendar.

This stretch could supply fans with a better look at who might be a real title contender, and who was propelling themselves on drafting tracks and road courses to kick off the season.

Joining the NASCAR O’Reilly Auto Parts Series this weekend is one of the best drivers at Phoenix Raceway in all of NASCAR’s three National Series.

Front Row Motorsports driver and current Craftsman Truck Series points leader, Chandler Smith, will drive Hettinger Racing’s No. 5 Mustang this weekend, in his first OAP Series start since the 2024 season finale at Phoenix.

That season, with Joe Gibbs Racing, Smith pieced together a career season, with two wins, 17 top fives, and 22 top tens, but fell short of making the Championship Four. Though he didn’t win the title, an early-season win at Phoenix propelled Smith into this great season.

In his combined nine starts at Phoenix across the Truck and OAP Series, Smith has two wins, seven top-fives, and nine top-tens. Expect Smith to be some form of threat this weekend at the 1-mile oval.

Let us know your thoughts on this! Join the discussion on Discord or X, and remember to follow us on Instagram, Facebook, and YouTube for more updates.

by Bryan Aguiar

Joe Gibbs Racing wanted to block Chris Gabehart. A judge stepped in. And then Kyle Busch dropped five words that said a whole lot more than they seemed. The JGR vs. Gabehart saga just took another turn, and now the driver who left in 2022 is subtly weighing in.

There’s legal maneuvering, pointed comments about accountability, and a hearing date circled in mid-March. But there’s also the bigger picture, past contract drama, shifting power inside the organization, and the possibility that silly season could get very interesting if the right domino tips. This story isn’t cooling off. If anything, it’s just getting started.

Watch Also: